Thursday, January 17, 2008

Orangeburg SC Seller -You should do what you should always do

The following article was not written by the blogger- but it is so much on target I had to share with you.

Sellers had it so good around Orangeburg SC Real Estate back in 2005-2006 that many never even did anything in preparation to sell thier homes. With less buyers fighting over homes and more homes wishing to be sold- it is time sellers did what they should have been doing all along- prepare the home to be ACCEPTED by the buyers and to obtain highest dollar in an otherwise down market- Mr. Sobel has made some very good suggestions.

By David Sobel

RISMEDIA, Jan. 17, 2008-You’ve all had that experience with a client where you drive up to a house and they don’t even want to go inside. It’s an immediate “un-appeal.” You may know the inside of the house shows much better, but you just can’t convince them to spend the time to even go inside. In today’s market where lots of choices in housing are available to the buyer, why should they?

Here are some easy, inexpensive fixes that will help create that outside appeal and get you one, giant step further to a sale.

1. Paint or stain the front and garage doors, especially if they show any weathering. These are the first visuals where a potential buyer focuses. If garage doors are metal and dented, they may need to be replaced.

2. Any old, basically abandoned sheds or small structures, must be removed, the area graded and the grass replaced.

3. Change any dated, outside light fixtures.

4. Fix that driveway. If it is blacktop, make sure cracks and crumbling areas are dug out and filled and then the whole driveway sealed. If it is cement, have large cracks filled and repaired professionally. The buyer must at least feel they can drive the moving truck in confidently!

5. Make sure landscaping bricks are in their proper placement. Mowing, weed-whipping sometimes moves them and this is something the homeowner rarely notices, but makes the property look unsightly.

6. Fill in bare dirt under large shade trees. Plant shade-tolerant plants in defined planters or groundcover. Landscape properly for that area.

7. All landscaping beds should be cleaned out and updated for the time of year it is in your region. Place new bedding material down.

8. Have trees and bushes pruned and trimmed. If a bush or tree is looking old or about to expire, remove it and replace it with a similar size and type if you can. If there is a tree limb(s) over the roof, have them removed.

9. If the house needs painting and a full paint job is not in the cards; have it touched up professionally in the worst, most visible spots. Paint shutters and fix them if they are hanging crooked. At least this may help get your client in the front door, even if they negotiate a full paint job into the sale later.

10. If the house is sided, have it power-washed and have gutters and windows cleaned. Window cleaning inside and out makes the house feel updated and fresh, rather than old and dingy.

11. Make sure grass is in good shape, weeds are removed, trimming done regularly. So many sellers fall down on this job the minute the house is listed, and this is critical to selling a house quickly, especially one where the owners have already moved out. In snowy climates, removal must be done regularly too. If owners have moved out, make sure you have an HWA Home Warranty to re-assure buyers.

12. Keep garbage and recycle containers inside the garage, along with all toys and equipment. Make sure the garage is neat and organized. Painted walls and floors also go a long way in this area and are inexpensive to do.

13. Decks should be washed and repainted or re-sealed; plantings around them cleaned, weed-free and looking good. Patio furniture should be in excellent condition. Even though it is in the backyard, this is the area where the family can envision enjoying the warm days and the new yard.

14. If the roof has missing shingles and they can be replaced inexpensively, suggest this be done as it may save negotiation over a completely new roof. Roof repair needs and costs should be minor or the homeowner might as well replace the entire roof.

15. If the homeowner wants to do a bit more, suggest solar lights lining the driveway or installing a more attractive front door with lead glass inserts and replacing plain doorknobs with something more custom.

16. If you have an evening showing, make sure lights are on outside and inside the house. This is warm and inviting.

17. If it’s a holiday season, by all means decorate the home! Just like sugar cookies or vanilla scent on the inside of the house, this really says “it’s a home” and I can see myself enjoying life here! In the least, always have some greenery or flowers for the season on the front step or porch; even a birdbath with a little garden around it says home.

Remember, most home buyers cannot visualize even these simple changes and clean ups in a house and the ones who can, will be looking for a reduced price. So to sell the house at top dollar and quickly, make it “appeal” to the many who will be seeing it rather than the few who are looking for a “fixer upper.” These people know what they want, go after it and need less assistance.

Finally, have neighbors or friends look at the finished results to see if you or the home owner has missed anything key that would be quick and easy to do. Use this article in your listing presentations so they can get started right away on these easy, inexpensive fixes and adapt the ideas to their home. When that home looks fabulous, update that picture on the Internet! This is especially important if the season has changed too and it’s a reward to your client too!

Sellers had it so good around Orangeburg SC Real Estate back in 2005-2006 that many never even did anything in preparation to sell thier homes. With less buyers fighting over homes and more homes wishing to be sold- it is time sellers did what they should have been doing all along- prepare the home to be ACCEPTED by the buyers and to obtain highest dollar in an otherwise down market- Mr. Sobel has made some very good suggestions.

By David Sobel

RISMEDIA, Jan. 17, 2008-You’ve all had that experience with a client where you drive up to a house and they don’t even want to go inside. It’s an immediate “un-appeal.” You may know the inside of the house shows much better, but you just can’t convince them to spend the time to even go inside. In today’s market where lots of choices in housing are available to the buyer, why should they?

Here are some easy, inexpensive fixes that will help create that outside appeal and get you one, giant step further to a sale.

1. Paint or stain the front and garage doors, especially if they show any weathering. These are the first visuals where a potential buyer focuses. If garage doors are metal and dented, they may need to be replaced.

2. Any old, basically abandoned sheds or small structures, must be removed, the area graded and the grass replaced.

3. Change any dated, outside light fixtures.

4. Fix that driveway. If it is blacktop, make sure cracks and crumbling areas are dug out and filled and then the whole driveway sealed. If it is cement, have large cracks filled and repaired professionally. The buyer must at least feel they can drive the moving truck in confidently!

5. Make sure landscaping bricks are in their proper placement. Mowing, weed-whipping sometimes moves them and this is something the homeowner rarely notices, but makes the property look unsightly.

6. Fill in bare dirt under large shade trees. Plant shade-tolerant plants in defined planters or groundcover. Landscape properly for that area.

7. All landscaping beds should be cleaned out and updated for the time of year it is in your region. Place new bedding material down.

8. Have trees and bushes pruned and trimmed. If a bush or tree is looking old or about to expire, remove it and replace it with a similar size and type if you can. If there is a tree limb(s) over the roof, have them removed.

9. If the house needs painting and a full paint job is not in the cards; have it touched up professionally in the worst, most visible spots. Paint shutters and fix them if they are hanging crooked. At least this may help get your client in the front door, even if they negotiate a full paint job into the sale later.

10. If the house is sided, have it power-washed and have gutters and windows cleaned. Window cleaning inside and out makes the house feel updated and fresh, rather than old and dingy.

11. Make sure grass is in good shape, weeds are removed, trimming done regularly. So many sellers fall down on this job the minute the house is listed, and this is critical to selling a house quickly, especially one where the owners have already moved out. In snowy climates, removal must be done regularly too. If owners have moved out, make sure you have an HWA Home Warranty to re-assure buyers.

12. Keep garbage and recycle containers inside the garage, along with all toys and equipment. Make sure the garage is neat and organized. Painted walls and floors also go a long way in this area and are inexpensive to do.

13. Decks should be washed and repainted or re-sealed; plantings around them cleaned, weed-free and looking good. Patio furniture should be in excellent condition. Even though it is in the backyard, this is the area where the family can envision enjoying the warm days and the new yard.

14. If the roof has missing shingles and they can be replaced inexpensively, suggest this be done as it may save negotiation over a completely new roof. Roof repair needs and costs should be minor or the homeowner might as well replace the entire roof.

15. If the homeowner wants to do a bit more, suggest solar lights lining the driveway or installing a more attractive front door with lead glass inserts and replacing plain doorknobs with something more custom.

16. If you have an evening showing, make sure lights are on outside and inside the house. This is warm and inviting.

17. If it’s a holiday season, by all means decorate the home! Just like sugar cookies or vanilla scent on the inside of the house, this really says “it’s a home” and I can see myself enjoying life here! In the least, always have some greenery or flowers for the season on the front step or porch; even a birdbath with a little garden around it says home.

Remember, most home buyers cannot visualize even these simple changes and clean ups in a house and the ones who can, will be looking for a reduced price. So to sell the house at top dollar and quickly, make it “appeal” to the many who will be seeing it rather than the few who are looking for a “fixer upper.” These people know what they want, go after it and need less assistance.

Finally, have neighbors or friends look at the finished results to see if you or the home owner has missed anything key that would be quick and easy to do. Use this article in your listing presentations so they can get started right away on these easy, inexpensive fixes and adapt the ideas to their home. When that home looks fabulous, update that picture on the Internet! This is especially important if the season has changed too and it’s a reward to your client too!

Monday, June 25, 2007

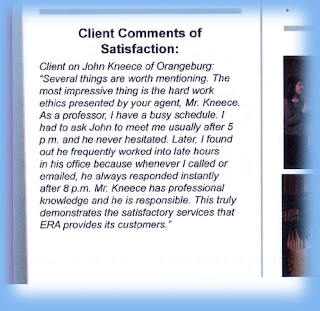

Giving Service in Orangeburg SC which amazes

Thursday, May 10, 2007

Rates in Orangeburg SC holding

In the past eight weeks, the average rate on a 30-year fixed has been as low as 6.19 percent and as high as 6.29 percent. Rates rarely remain in such a narrow range for two months. They have been static because economic news has been pulling equally in two directions. The low unemployment rate and bigger paychecks tend to push interest rates higher, while the faltering real estate market and slowing productivity tend to pull rates lower.

Labels: homes in Orangeburg SC

Friday, February 09, 2007

NEW DEAL Orangeburg SC

Four Bedrooms and More

Benjamin Boulevard Orangeburg, SC 29118

Price: $216,900

Status: New Listing Bedrooms: 4 Baths: 3 Year Built: 1975 Square Feet: 2882 Lot Size: .78 Garage: 3+ Seller Paid Home Warranty: American Home Shield Amenities:: Walk-in attic Subdivision:: Creekmoor-North side Orangeburg

Features:

Fireplace, Main Floor Bathroom, Central Air, Main Floor Bedroom, Den/Office, Dining Room, Family Room, Laundry Room

Beautiful Four bedroom brick home with fireplace and two car garage attached and two nice out buildings; fenced rear yard, patio and many other wonderful features. Master bedroom and two others downstairs plus a dedicated office (could be a fifth bedroom/nursery). There is a bedroom with private bath upstairs (second master) with a super-sized sitting area/den. Walk-in attic space.

John KneeceERA Wilder Realty Inc.Phone: 803-378-5208OFFICE (8 AM - 5 PM):

803-378-5208

info@johnkneece.comwww.johnkneece.com

Equal Housing OpportunityAll information provided is deemed reliable but is not guaranteed and should be independently verified.

Benjamin Boulevard Orangeburg, SC 29118

Price: $216,900

Status: New Listing Bedrooms: 4 Baths: 3 Year Built: 1975 Square Feet: 2882 Lot Size: .78 Garage: 3+ Seller Paid Home Warranty: American Home Shield Amenities:: Walk-in attic Subdivision:: Creekmoor-North side Orangeburg

Features:

Fireplace, Main Floor Bathroom, Central Air, Main Floor Bedroom, Den/Office, Dining Room, Family Room, Laundry Room

Beautiful Four bedroom brick home with fireplace and two car garage attached and two nice out buildings; fenced rear yard, patio and many other wonderful features. Master bedroom and two others downstairs plus a dedicated office (could be a fifth bedroom/nursery). There is a bedroom with private bath upstairs (second master) with a super-sized sitting area/den. Walk-in attic space.

John KneeceERA Wilder Realty Inc.Phone: 803-378-5208OFFICE (8 AM - 5 PM):

803-378-5208

info@johnkneece.comwww.johnkneece.com

Equal Housing OpportunityAll information provided is deemed reliable but is not guaranteed and should be independently verified.

Thursday, January 11, 2007

Younger Americans Earning more and smart enough to BUY a home of their own

Orangeburg South Carolina

Younger Generations Buying More Houses

Americans earning at least $75,000 per year are buying more houses than their parents did at a comparable age, with each generation outpacing the previous generation's home purchase trends, according to the Coldwell Banker 2006 Homeownership in America Study.

The study's data shows that 66% of survey respondents in the Silent Generation (age 61 and up) have owned between two and five homes. Already, 66% of Baby Boomers (age 42 to 60) have owned a similar two to five homes. The younger generations surveyed are mimicking these homebuying habits. About half (48%) of Generation Xers (age 32 to 41), and more than one-third (36%) of Echo Boomers (age 31 and younger) have owned between two and five homes. Approximately 58% of respondents have owned more homes than their parents did when their parents were at a comparable age.

"These findings suggest that this trend will continue as the younger, upper income generations age," says Jim Gillespie, president and chief executive officer of Coldwell Banker Real Estate Corp.

"Baby Boomers have already equaled the homeownership pace of those 61 and older, and they remain in their prime homebuying years. The fact that Generation X and Echo Boomers are indicating that they have owned multiple homes already shows that they understand the value of buying and owning real estate."

The study also points out that homebuyers do not appear to be collecting houses as a means to expand their financial portfolios by constantly moving to bigger and more expensive houses. Instead, they move according to lifestyle needs.

If you are younger and smarter... and have a wish for good climate and friendly people

CALL John Kneece today 866-419-7539 (toll free)

info@JohnKneece.com (also a free function)

www.BuyerHelper.com

www.ERAorangeburgSC.com

www.OrangeburgHomes.com

1995 Saint Matthews Road

Orangeburg, SC 29118

ERA WILDER REALTY, INC.

We have agents in both North Carolina and South Carolina to serve your needs in housing. Call me today to be properly directed to the nearest office and the most expert agent in that office.

Younger Generations Buying More Houses

Americans earning at least $75,000 per year are buying more houses than their parents did at a comparable age, with each generation outpacing the previous generation's home purchase trends, according to the Coldwell Banker 2006 Homeownership in America Study.

The study's data shows that 66% of survey respondents in the Silent Generation (age 61 and up) have owned between two and five homes. Already, 66% of Baby Boomers (age 42 to 60) have owned a similar two to five homes. The younger generations surveyed are mimicking these homebuying habits. About half (48%) of Generation Xers (age 32 to 41), and more than one-third (36%) of Echo Boomers (age 31 and younger) have owned between two and five homes. Approximately 58% of respondents have owned more homes than their parents did when their parents were at a comparable age.

"These findings suggest that this trend will continue as the younger, upper income generations age," says Jim Gillespie, president and chief executive officer of Coldwell Banker Real Estate Corp.

"Baby Boomers have already equaled the homeownership pace of those 61 and older, and they remain in their prime homebuying years. The fact that Generation X and Echo Boomers are indicating that they have owned multiple homes already shows that they understand the value of buying and owning real estate."

The study also points out that homebuyers do not appear to be collecting houses as a means to expand their financial portfolios by constantly moving to bigger and more expensive houses. Instead, they move according to lifestyle needs.

If you are younger and smarter... and have a wish for good climate and friendly people

CALL John Kneece today 866-419-7539 (toll free)

info@JohnKneece.com (also a free function)

www.BuyerHelper.com

www.ERAorangeburgSC.com

www.OrangeburgHomes.com

1995 Saint Matthews Road

Orangeburg, SC 29118

ERA WILDER REALTY, INC.

We have agents in both North Carolina and South Carolina to serve your needs in housing. Call me today to be properly directed to the nearest office and the most expert agent in that office.

Thursday, January 04, 2007

Save Time and Money in Orangeburg SC Real Estate Market

Life can be a little easier.

Save time and irritation. Work with a REALTOR e-PRO® Certified real estate professional who provides both buyers and sellers with high quality, timely information using the resources of the Internet.

REALTOR e-PRO® Internet Professionals maximize your ability to leverage the enormous power of the Internet when you are buying and selling property.

John Kneece

ERA Wilder Realty, Inc.

1995 Saint Matthews Road

Orangeburg, SC 29118

info@JohnKneece.com

TOLL FREE 866-419-7539

(local) 803-378-5208

Sixteen plus years serving the needs of buyers and sellers in the market in and around Orangeburg, SC in amazing ways! Call John today!

Thursday, December 14, 2006

Window of Opportunity for Orangeburg SC Buyers

Daily Real Estate News December 11, 2006

Existing-Home Sales to Trend Upward in 2007

Existing-home sales are expected to rise gradually in 2007 from current levels, with annual totals slightly lower than 2006, while new-home sales will continue to slide, according to the latest forecast by the NATIONAL ASSOCIATION OF REALTORS®. David Lereah, NAR’s chief economist, says market conditions will vary around the country next year.“Roughly three-quarters of the country will experience a sluggish expansion in 2007, while other areas should continue to contract for at least part of the year,” he says. “Most of the correction in home prices is behind us, but general gains in value next year will be modest by historical standards.

"For Buyers, a Window of Opportunity" Buyers, especially first-time buyers, with the combined benefits of seller flexibility and an unexpected drop in mortgage interest rates, have a window of opportunity,” he adds. “These conditions will persist in many areas until early spring when inventory supplies are likely to become more balanced.” Existing-home sales for 2006, finishing the third-best year on record, are projected at 6.47 million, a decline of 8.6 percent from 2005. For 2007, sales expected to rise steadily to an annual total of 6.40 million, which would be 1 percent lower than this year’s total. “By the fourth quarter of 2007, existing-home sales will be 4.6 percent higher than the current quarter,” Lereah says.

Much can be said for the opportunities which come and go in the buying and selling of real estate- most agents can talk about how they will help you- click on this link to see how this is done on a routine basis.

http://johnkneece.com/custom3.shtml

John Kneece

ERA Wilder Realty

1995 Saint Matthews Road

Orangeburg, SC 29118

(toll Free) 866-419-7539

(local) 378-5208

EMAIL: mailto:info@johnkneece.com

Existing-Home Sales to Trend Upward in 2007

Existing-home sales are expected to rise gradually in 2007 from current levels, with annual totals slightly lower than 2006, while new-home sales will continue to slide, according to the latest forecast by the NATIONAL ASSOCIATION OF REALTORS®. David Lereah, NAR’s chief economist, says market conditions will vary around the country next year.“Roughly three-quarters of the country will experience a sluggish expansion in 2007, while other areas should continue to contract for at least part of the year,” he says. “Most of the correction in home prices is behind us, but general gains in value next year will be modest by historical standards.

"For Buyers, a Window of Opportunity" Buyers, especially first-time buyers, with the combined benefits of seller flexibility and an unexpected drop in mortgage interest rates, have a window of opportunity,” he adds. “These conditions will persist in many areas until early spring when inventory supplies are likely to become more balanced.” Existing-home sales for 2006, finishing the third-best year on record, are projected at 6.47 million, a decline of 8.6 percent from 2005. For 2007, sales expected to rise steadily to an annual total of 6.40 million, which would be 1 percent lower than this year’s total. “By the fourth quarter of 2007, existing-home sales will be 4.6 percent higher than the current quarter,” Lereah says.

Much can be said for the opportunities which come and go in the buying and selling of real estate- most agents can talk about how they will help you- click on this link to see how this is done on a routine basis.

http://johnkneece.com/custom3.shtml

John Kneece

ERA Wilder Realty

1995 Saint Matthews Road

Orangeburg, SC 29118

(toll Free) 866-419-7539

(local) 378-5208

EMAIL: mailto:info@johnkneece.com

Tuesday, December 12, 2006

Owner Financing Available on Good Terms

The seller of this wonderful country home is willing to help you with the financing- you put down 6% ( around $6000) and he will allow you to make payments directly to him for three years... those would run under $700 per month- it would be your house without all the wasted money on closing costs and other fees which actually you never get back if and when you ever sell your home!!

After three years (assuming you have made 36 timely payments) your credit history should be good enough to qualify for bank financing- perhaps things improve faster than that--it is your call.

For details on how this works call JOHN KNEECE at (toll free) 866-419-7539 and get the whole story! Visit http://JohnKneece.com to see more photos of this fine home which by the way also has 2.7 acres with it and another 2.7 aceres could be added into the deal- again...it's your call!

Monday, October 02, 2006

The Government is NOW watching out for Orangeburg buyers-

The government is NOW looking out for consumers...

Buyers working with John Kneece and Orangeburg Homes dot Com have been

protected all along from mortgages they cannot service....

RISMEDIA, October 2, 2006—The Center for Responsible Lending commends federal regulators who said recently they would start requiring lenders to consider whether a borrower can repay when they make certain kinds of home loans. But the regulators missed the boat in helping all the consumers at risk from mortgages that could blow up on them. Lenders have sold billions of dollars of complicated, difficult-to- understand adjustable-rate option mortgages to homebuyers in the last few years without regard to their ability to repay. As the banks pushed more people into buying houses they couldn't afford, the housing market boomed and lenders prospered. Now, as interest rates rise and the borrower's monthly house payments go up accordingly, many buyers are left high and dry, facing foreclosure; and the housing market is endangered, raising the possibility of a recession. "Federal financial regulators took a step toward making the mortgage market safer for borrowers today," said Michael D. Calhoun, president of the Center for Responsible Lending, "although there is much more to do." The Office of the Comptroller of the Currency, the nation's main federal bank regulator; the Board of Governors of the Federal Reserve System; the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, the Treasury Department and the National Credit Union Administration said Friday that lenders must tighten the standards for making loans that negatively amortize -- that is, when the borrower's monthly payment is lower than the interest due, and the loan balance increases rather than decreases with every payment. But regulators should expand their scrutiny to a much broader piece of the mortgage market -- the more conventional sub-prime adjustable-rate mortgages, or ARMs, whose monthly payments can also sharply rise. They are known as "exploding ARMs," and like the negatively amortizing loans, lenders have pushed them on borrowers by flourishing low, introductory "teaser" rates that will sharply rise. The Center for Responsible Lending, a nonprofit research and advocacy group that fights predatory lenders, finds several more places in the regulatory guidance, as it's called, where the regulators fell short in protecting consumers today. It does not apply to state-regulated mortgage companies that make loans but don't take deposits. The regulators said they would work with regulators of these companies to set the same standards. It is important they do: Almost 60 percent of the loans in the sub-prime market, where people of modest means and with weaker credit ratings borrow, are not subject to scrutiny by the federal regulators issuing these guidelines today. The regulators also say lenders must consider incentives for loan officers to make the best kind of loan to a borrower and not push only option adjustable-rate-mortgages simply because they are often more profitable for the lender. The Center for Responsible Lending urges regulators and banks to do more about this problem. Finally, the center calls on lenders and the Wall Street firms that buy these loans to work with borrowers trapped in loans with payments they can't afford. The industry pushed these loans; now it has a duty to help borrowers avoid losing their homes. "The lenders, the regulators, the consumer groups and consumers themselves must all do more to make sure these mortgages are bought and sold wisely and fairly," said Mr. Calhoun.

Saturday, September 23, 2006

People Have Asked- How is the Weather in Orangeburg SC

Click on this link to get the rainfall amount for last year, the high and low temperature daily for last year, and the snowfall.. Folks who live here will laugh at the word 'snowfall' with regards to Orangeburg, Bamberg, and Calhoun Counties.

LAST YEAR'S WEATHER ORANGEBURG SC

Thanks for your interest in Orangeburg SC- To learn more of Orangeburg SC and points beyond click on this link:

Good Stuff to know about Orangeburg SC

TO contact John Kneece

803-378-5208

info@johnkneece.com

ERA WILDER REALTY INC

1995 St. Matthews Road

Orangeburg, SC 29118

LAST YEAR'S WEATHER ORANGEBURG SC

Thanks for your interest in Orangeburg SC- To learn more of Orangeburg SC and points beyond click on this link:

Good Stuff to know about Orangeburg SC

TO contact John Kneece

803-378-5208

info@johnkneece.com

ERA WILDER REALTY INC

1995 St. Matthews Road

Orangeburg, SC 29118

Thursday, September 21, 2006

Trulia.com makes ERA listings easy to find

ERA Real Estate Enables Consumers to Search

Property Listings on Trulia.com

New relationship will allow easier consumer access to more than 76,000 ERA-represented property listings RISMEDIA, September 21, 2006—ERA Real Estate has announced a comprehensive system-wide test marketing agreement with San Francisco-based Trulia, a real estate search engine company. This new relationship will allow easier consumer access to more than 76,000 ERA-represented property listings at http://www.trulia.com/ using the firm’s vertical search technology that directs consumers to the complete property listing information on ERA.com

JOHN KNEECE

ERA Wilder Realty, Inc.

1995 St. Matthews Road

Orangeburg, SC 29118

ERA Wilder Realty, Inc.

1995 St. Matthews Road

Orangeburg, SC 29118

info@JohnKneece.com Orangeburg information center for Real Estate

Monday, September 18, 2006

Be prepared for what could (and will) happen eventually- Orangeburg SC

READY OR NOT...

Emergencies are never planned, but can happen in a heartbeat. Ever had a blackout at your home...and as you waited for the power to come back on, started to wonder what would happen if the minutes turned into hours or days? Would you and your family be prepared? The Department of Homeland Security (DHS) wants to make sure you are, and has identified September as National Preparedness Month. An emergency situation could be an earthquake, hurricane, potential terrorist threat, or even just that blackout.

Hopefully you will never be faced with an emergency situation of your own, but if you are, having an emergency kit will help ensure that you and your loved ones will have the bare necessities such as food, water, and items to keep you warm. And determining all the right items for each member of your family, pets, and those with special needs could normally be a very grueling process. But the DHS has made this process very simple.

To help you get started preparing your emergency kit, The Department of Homeland Security has developed a user friendly website that allows you to download and print all of the items that you will need to gather. Just hit this link: DHS Emergency Kit, and you can get a quick list of the basics, such as water, food, radio, flashlight and batteries - including a printable list of the quantities and types that should be purchased, based on your families needs. There's also valuable information on "Unique Family Needs" which includes items for infants, pets, and those with special needs.

So take a few minutes to visit the site, and forward this article on to your friends, family members, and colleagues...or better yet, prepare a starter kit for them as a gift. When the power snaps off unexpectedly...or worse...don't be caught unprepared.

Emergencies are never planned, but can happen in a heartbeat. Ever had a blackout at your home...and as you waited for the power to come back on, started to wonder what would happen if the minutes turned into hours or days? Would you and your family be prepared? The Department of Homeland Security (DHS) wants to make sure you are, and has identified September as National Preparedness Month. An emergency situation could be an earthquake, hurricane, potential terrorist threat, or even just that blackout.

Hopefully you will never be faced with an emergency situation of your own, but if you are, having an emergency kit will help ensure that you and your loved ones will have the bare necessities such as food, water, and items to keep you warm. And determining all the right items for each member of your family, pets, and those with special needs could normally be a very grueling process. But the DHS has made this process very simple.

To help you get started preparing your emergency kit, The Department of Homeland Security has developed a user friendly website that allows you to download and print all of the items that you will need to gather. Just hit this link: DHS Emergency Kit, and you can get a quick list of the basics, such as water, food, radio, flashlight and batteries - including a printable list of the quantities and types that should be purchased, based on your families needs. There's also valuable information on "Unique Family Needs" which includes items for infants, pets, and those with special needs.

So take a few minutes to visit the site, and forward this article on to your friends, family members, and colleagues...or better yet, prepare a starter kit for them as a gift. When the power snaps off unexpectedly...or worse...don't be caught unprepared.

Tuesday, September 12, 2006

IRS does have some soft spots- Orangeburg SC

What if having a parent move in with you creates quarters that are too close for comfort...and you are forced to sell your home?

Well, the IRS wants to help - and may even provide a tax break for taking an ailing parent into your home. Let's take a closer look. Under normal circumstances, if you sell your home prior to living in the property for two full years, you are normally subject to pay capital gains on the profit made. There is an exclusion that allows for $500,000 of tax free gain if you are married or half that if you are single - but you must have lived in the home for two of the past five years.

However, according to the IRS, if you take an ailing parent into your home and therefore are forced to sell, you can still get a pro rated tax break, even if you have not been in the home for the full two years.

Well, the IRS wants to help - and may even provide a tax break for taking an ailing parent into your home. Let's take a closer look. Under normal circumstances, if you sell your home prior to living in the property for two full years, you are normally subject to pay capital gains on the profit made. There is an exclusion that allows for $500,000 of tax free gain if you are married or half that if you are single - but you must have lived in the home for two of the past five years.

However, according to the IRS, if you take an ailing parent into your home and therefore are forced to sell, you can still get a pro rated tax break, even if you have not been in the home for the full two years.

Friday, September 08, 2006

Credit for those who have none in Orangeburg SC and beyond?

New scoring tools empower credit weaklings

By Amy Buttell Crane

If you've been rejected for a mortgage or other loan because of a bad FICO score, don't despair. New forms of credit scoring use your payment record on utility bills, rental units and payday loans to assess your ability to repay loans.

An estimated 50 million consumers are locked out of access to credit because they lack the credit history needed to generate a decent FICO score. The FICO score estimates your ability to repay based on your past credit history as detailed in traditional credit reports.

Fair Isaac Corp., the company that pioneered this form of credit scoring, produces the FICO score and is offering one of the new credit scores, which it calls the FICO Expansion score. Along with other players in this rapidly expanding market, Fair Isaac hopes to attract lenders eager to expand their customer base.

"One of the problems for people who don't have good FICO scores is the collection of enough positive data to make the score an effective predictive tool," says Tena Friery, research director of the Privacy Rights Clearinghouse, a California-based consumer advocacy group. "Estimates are that 50 million consumers are affected by a lack of credit history, so this score has the potential to give people the chance to own a home who otherwise wouldn't be able to get into the market."

The various scoresBecause of Fair Isaac's status as the 800-pound gorilla in the credit scoring market, the FICO Expansion score has a built-in advantage over the other types of scores. Here's a breakdown of the different types of scores.

Types of scores

•

FICO expansion score

•

PRBC

•

Anthem score

•

eFunds

FICO Expansion score. Drawing on alternative credit data such as bank account records, payday loan payment records and installment purchase plans, Fair Isaac produces a credit score that is modeled on the traditional FICO score's 300-to-850 point range. "In developing the Expansion score, Fair Isaac analyzed anonymous alternative credit data to statistically determine what factors are most predictive of future credit performance," said Lisa Nelson, vice president of business operations for Fair Isaac in an appearance before the House Financial Services Committee in May 2006. "Factors that do not have predictive value and factors that by law cannot be used in the credit decision are excluded from consideration."

PRBC. PRBC, which stands for Payment Reporting Builds Credit, turns the traditional credit scoring model on its head, offering consumers the chance to proactively build a credit profile through tracking their payment history in such areas as rent, private mortgages, phone, utility, insurance premiums and child support payments. Consumers can sign up through AccountNow, a partner with PRBC, and arrange to have their bills paid through this service. All payments will automatically be forwarded to PRBC and be included in your credit profile. There are fees involved to enroll in the AccountNow Vantage MasterCard program, which is part of the AccountNow service.

Anthem score. Developed by First American CREDCO, which processes and distributes credit information on consumers, the Anthem score is similar to the FICO Expansion score. The Anthem score is a two-tiered score: The first score comes from First American's nontraditional credit report; the second is a numerical risk assessment score. Scoring is based on a consumer's history of paying rent, utilities, insurance and child support expenses. In building the risk score, Anthem takes into account how long a consumer has been paying bills in a timely fashion as well as what types of credit the consumer is using.

eFunds. EFunds is the parent company of the ChexSystem banking clearing house. The eFunds Debit Report provides lenders with an overview of a consumer's check-writing history, check order history, account-opening inquiries, deposit account collections and any accounts closed for fraud or abuse.

The positivesThese new forms of credit scoring are a wedge into the traditional credit market that many consumers can use to prove to lenders that they are a good credit risk. "There are many people who may be creditworthy but who don't get credit because of the limits of the traditional FICO score," says Bruce McClary of Clearpoint, a consumer credit counseling agency. "For example, many Hispanic immigrants use cash rather than credit. They save, which is very admirable, but they aren't establishing any type of credit history."

Many other consumers may be able to access credit through nontraditional scoring methods. These include recent high school or college graduates, divorcees or widows and people with some blemishes on their traditional credit report.

"These scores open up a whole new world of opportunity for people who have chosen not to access credit or who have had issues with credit," says Cate Williams, vice president for financial literacy for Money Management International, a consumer credit counseling agency.

The negativesWhile many consumers who haven't had access to credit may applaud these new scores, other consumers may rue the day that a lender relied on one of these scores if that credit isn't used wisely.

"There are problems that could arise with any system. There is always the potential for abuse where you could have predatory lenders using these scores to reach people who they would otherwise not be able to get to," says McClary.

Williams warns consumers not to be tempted into taking on more credit than they can handle. "If you get a credit card as a result of these new scoring models, ask yourself what do you need that card for," she says. "Nine out of 10 people will say it is only for emergencies, but a shoe sale or dinner out is not an emergency. Also find out what costs are involved in any loan or credit card."

As with traditional credit reports and the traditional FICO score, the newer scores are only as good as the data they are built on. Just as there can be mistakes in your credit report, inaccurate information obtained on your nontraditional payments can negatively impact your ability to get loans. "Fair Isaac is becoming a specialized consumer-reporting agency so the Expansion score will be a dispute-resolution process where you can fix problems with this score," says Friery.

Since PRBC is consumer-driven, consumers will have free access to their data once they are enrolled in this program. At this time, it's not clear what access consumers will have to eFunds Debit Reports or Anthem scores since they are so new.

By Amy Buttell Crane

If you've been rejected for a mortgage or other loan because of a bad FICO score, don't despair. New forms of credit scoring use your payment record on utility bills, rental units and payday loans to assess your ability to repay loans.

An estimated 50 million consumers are locked out of access to credit because they lack the credit history needed to generate a decent FICO score. The FICO score estimates your ability to repay based on your past credit history as detailed in traditional credit reports.

Fair Isaac Corp., the company that pioneered this form of credit scoring, produces the FICO score and is offering one of the new credit scores, which it calls the FICO Expansion score. Along with other players in this rapidly expanding market, Fair Isaac hopes to attract lenders eager to expand their customer base.

"One of the problems for people who don't have good FICO scores is the collection of enough positive data to make the score an effective predictive tool," says Tena Friery, research director of the Privacy Rights Clearinghouse, a California-based consumer advocacy group. "Estimates are that 50 million consumers are affected by a lack of credit history, so this score has the potential to give people the chance to own a home who otherwise wouldn't be able to get into the market."

The various scoresBecause of Fair Isaac's status as the 800-pound gorilla in the credit scoring market, the FICO Expansion score has a built-in advantage over the other types of scores. Here's a breakdown of the different types of scores.

Types of scores

•

FICO expansion score

•

PRBC

•

Anthem score

•

eFunds

FICO Expansion score. Drawing on alternative credit data such as bank account records, payday loan payment records and installment purchase plans, Fair Isaac produces a credit score that is modeled on the traditional FICO score's 300-to-850 point range. "In developing the Expansion score, Fair Isaac analyzed anonymous alternative credit data to statistically determine what factors are most predictive of future credit performance," said Lisa Nelson, vice president of business operations for Fair Isaac in an appearance before the House Financial Services Committee in May 2006. "Factors that do not have predictive value and factors that by law cannot be used in the credit decision are excluded from consideration."

PRBC. PRBC, which stands for Payment Reporting Builds Credit, turns the traditional credit scoring model on its head, offering consumers the chance to proactively build a credit profile through tracking their payment history in such areas as rent, private mortgages, phone, utility, insurance premiums and child support payments. Consumers can sign up through AccountNow, a partner with PRBC, and arrange to have their bills paid through this service. All payments will automatically be forwarded to PRBC and be included in your credit profile. There are fees involved to enroll in the AccountNow Vantage MasterCard program, which is part of the AccountNow service.

Anthem score. Developed by First American CREDCO, which processes and distributes credit information on consumers, the Anthem score is similar to the FICO Expansion score. The Anthem score is a two-tiered score: The first score comes from First American's nontraditional credit report; the second is a numerical risk assessment score. Scoring is based on a consumer's history of paying rent, utilities, insurance and child support expenses. In building the risk score, Anthem takes into account how long a consumer has been paying bills in a timely fashion as well as what types of credit the consumer is using.

eFunds. EFunds is the parent company of the ChexSystem banking clearing house. The eFunds Debit Report provides lenders with an overview of a consumer's check-writing history, check order history, account-opening inquiries, deposit account collections and any accounts closed for fraud or abuse.

The positivesThese new forms of credit scoring are a wedge into the traditional credit market that many consumers can use to prove to lenders that they are a good credit risk. "There are many people who may be creditworthy but who don't get credit because of the limits of the traditional FICO score," says Bruce McClary of Clearpoint, a consumer credit counseling agency. "For example, many Hispanic immigrants use cash rather than credit. They save, which is very admirable, but they aren't establishing any type of credit history."

Many other consumers may be able to access credit through nontraditional scoring methods. These include recent high school or college graduates, divorcees or widows and people with some blemishes on their traditional credit report.

"These scores open up a whole new world of opportunity for people who have chosen not to access credit or who have had issues with credit," says Cate Williams, vice president for financial literacy for Money Management International, a consumer credit counseling agency.

The negativesWhile many consumers who haven't had access to credit may applaud these new scores, other consumers may rue the day that a lender relied on one of these scores if that credit isn't used wisely.

"There are problems that could arise with any system. There is always the potential for abuse where you could have predatory lenders using these scores to reach people who they would otherwise not be able to get to," says McClary.

Williams warns consumers not to be tempted into taking on more credit than they can handle. "If you get a credit card as a result of these new scoring models, ask yourself what do you need that card for," she says. "Nine out of 10 people will say it is only for emergencies, but a shoe sale or dinner out is not an emergency. Also find out what costs are involved in any loan or credit card."

As with traditional credit reports and the traditional FICO score, the newer scores are only as good as the data they are built on. Just as there can be mistakes in your credit report, inaccurate information obtained on your nontraditional payments can negatively impact your ability to get loans. "Fair Isaac is becoming a specialized consumer-reporting agency so the Expansion score will be a dispute-resolution process where you can fix problems with this score," says Friery.

Since PRBC is consumer-driven, consumers will have free access to their data once they are enrolled in this program. At this time, it's not clear what access consumers will have to eFunds Debit Reports or Anthem scores since they are so new.

Wednesday, September 06, 2006

Income grows faster than National Average in Orangeburg SC

Personal income growth in S.C. metros surpassed national average in 2005

By Dan McCue , Staff Writer

Personal income growth in South Carolina’s three major metropolitan areas surpassed the national average in 2005, and grew far faster than the nation’s inflation rate, according to the U.S. Bureau of Economic Analysis.

Between 2004 and 2005, personal income in the combined Charleston/North Charleston metropolitan statistical area grew 6.8%, while personal income in Columbia grew 5.3% and in Greenville 5.2%.

On average across the nation, personal income grew by 5% in 2005, down from a 6% growth rate in 2004. Three-fourths of the metropolitan areas included in the survey saw a slowdown in personal income growth during the survey period, according to the BEA.

Despite the slowdown, 2005 per capita income grew faster than inflation—2.9% as measured by the national price index for personal consumption expenditure—in nearly three-quarters of the metropolitan areas measured.

BEA analysts attributed much of the overall slowdown in income growth to the after affects of Hurricanes Katrina and Rita, which sharply reduced income growth along the Gulf Coast.

However, some communities actually benefited from the disaster with personal income increasing in Alexandria, La., and Beaumont-Port Arthur, Texas.

Elsewhere, strong per capita personal income growth was associated with growth in the military sector while weak growth was associated with the motor vehicles and parts industry.

Five metropolitan areas with an economic base dominated by the military—Hinesville-Fort Stewart, Ga; Jacksonville, Fla.; Fayetteville, N.C.; Clarksville, Tenn.; and Killeen-Temple-Fort Hood, Texas—were among the 10 fastest growing metropolitan areas in 2005.

Five metropolitan areas— Kankakee-Bradley, Ill.; Monroe, Mich.; Kokomo, Ind.; Champaign-Urbana, Ill.; and Flint, Mich.—in the Great Lakes region, where the auto industry is slumping, were among the 10 slowest growing metropolitan areas.

By Dan McCue , Staff Writer

Personal income growth in South Carolina’s three major metropolitan areas surpassed the national average in 2005, and grew far faster than the nation’s inflation rate, according to the U.S. Bureau of Economic Analysis.

Between 2004 and 2005, personal income in the combined Charleston/North Charleston metropolitan statistical area grew 6.8%, while personal income in Columbia grew 5.3% and in Greenville 5.2%.

On average across the nation, personal income grew by 5% in 2005, down from a 6% growth rate in 2004. Three-fourths of the metropolitan areas included in the survey saw a slowdown in personal income growth during the survey period, according to the BEA.

Despite the slowdown, 2005 per capita income grew faster than inflation—2.9% as measured by the national price index for personal consumption expenditure—in nearly three-quarters of the metropolitan areas measured.

BEA analysts attributed much of the overall slowdown in income growth to the after affects of Hurricanes Katrina and Rita, which sharply reduced income growth along the Gulf Coast.

However, some communities actually benefited from the disaster with personal income increasing in Alexandria, La., and Beaumont-Port Arthur, Texas.

Elsewhere, strong per capita personal income growth was associated with growth in the military sector while weak growth was associated with the motor vehicles and parts industry.

Five metropolitan areas with an economic base dominated by the military—Hinesville-Fort Stewart, Ga; Jacksonville, Fla.; Fayetteville, N.C.; Clarksville, Tenn.; and Killeen-Temple-Fort Hood, Texas—were among the 10 fastest growing metropolitan areas in 2005.

Five metropolitan areas— Kankakee-Bradley, Ill.; Monroe, Mich.; Kokomo, Ind.; Champaign-Urbana, Ill.; and Flint, Mich.—in the Great Lakes region, where the auto industry is slumping, were among the 10 slowest growing metropolitan areas.

Thursday, August 31, 2006

Buyers beware- not all lenders have your interest at heart in Orangeburg SC Real Estate mortgages

Mortgage insurance tries to shake piggybacks

By Holden Lewis

(Thanks Mr. Lewis- my web prospects appreciate my providing them with your articles- they cannot find them on their own most of the time)

You can get lower monthly payments in some cases by getting a home loan with mortgage insurance rather than a piggyback loan. Don't assume that your loan officer or mortgage broker knows this.

"Our message to consumers is look at all the options," says Sal Miosi, vice president of marketing for mortgage insurer MGIC. "In many cases, it's a more compelling offer."

Mortgage insurance has become competitive with piggyback loans because of two developments. First, short-term interest rates rose during the Federal Reserve's two-year rate-hike campaign. That raised rates on the home equity loans and lines of credit that piggyback mortgages use. Second, mortgage insurance companies started pushing single-premium policies that could be financed as part of the loan.

The smaller your down payment on a house, the more likely you are to default on the mortgage and, thereby, cost the lender money and strife. The loan is considered quite risky if the down payment is less than 20 percent. One solution is mortgage insurance.

You pay, lender benefits

The borrower pays for mortgage insurance, but the lender is the beneficiary. Mortgage insurance reimburses the holder of the loan for foreclosure-related expenses such as missed payments, attorney fees and house repairs. The government offers mortgage insurance through the Department of Veterans Affairs and the Federal Housing Administration, and private companies provide the bulk of policies. This article addresses private mortgage insurance.

The cost of mortgage insurance varies depending on the size of the down payment and the borrower's credit history. It can be expensive, so the mortgage industry devised a way around it: piggyback loans. With a piggyback, the borrower splits the home loan in two: a primary mortgage for 80 percent, and then a home equity loan or credit line for 20 percent minus the down payment. Structuring a loan this way eliminates the requirement for mortgage insurance.

Piggybacks are described with three numbers that add up to 100. Each number is a percentage, starting with the primary mortgage, followed by the size of the equity loan and ending with the size of the down payment. If you made a 5 percent down payment, you would get a mortgage for 80 percent of the price, borrow 15 percent as an equity loan or credit line and pay 5 percent cash. That would be called an 80-15-5 piggyback.

Two or three years ago, when you could get a home equity line of credit at 4 percent or 5 percent, piggybacks were almost always cheaper. But now the average line of credit sports a rate north of 8 percent, and the average home equity loan is a shade under 8 percent. And rates on credit lines and equity loans usually run a little higher on piggybacks.

Bottom line: Piggyback loans have higher monthly payments than they used to have, while mortgage insurance costs the same.

By Holden Lewis

(Thanks Mr. Lewis- my web prospects appreciate my providing them with your articles- they cannot find them on their own most of the time)

You can get lower monthly payments in some cases by getting a home loan with mortgage insurance rather than a piggyback loan. Don't assume that your loan officer or mortgage broker knows this.

"Our message to consumers is look at all the options," says Sal Miosi, vice president of marketing for mortgage insurer MGIC. "In many cases, it's a more compelling offer."

Mortgage insurance has become competitive with piggyback loans because of two developments. First, short-term interest rates rose during the Federal Reserve's two-year rate-hike campaign. That raised rates on the home equity loans and lines of credit that piggyback mortgages use. Second, mortgage insurance companies started pushing single-premium policies that could be financed as part of the loan.

The smaller your down payment on a house, the more likely you are to default on the mortgage and, thereby, cost the lender money and strife. The loan is considered quite risky if the down payment is less than 20 percent. One solution is mortgage insurance.

You pay, lender benefits

The borrower pays for mortgage insurance, but the lender is the beneficiary. Mortgage insurance reimburses the holder of the loan for foreclosure-related expenses such as missed payments, attorney fees and house repairs. The government offers mortgage insurance through the Department of Veterans Affairs and the Federal Housing Administration, and private companies provide the bulk of policies. This article addresses private mortgage insurance.

The cost of mortgage insurance varies depending on the size of the down payment and the borrower's credit history. It can be expensive, so the mortgage industry devised a way around it: piggyback loans. With a piggyback, the borrower splits the home loan in two: a primary mortgage for 80 percent, and then a home equity loan or credit line for 20 percent minus the down payment. Structuring a loan this way eliminates the requirement for mortgage insurance.

Piggybacks are described with three numbers that add up to 100. Each number is a percentage, starting with the primary mortgage, followed by the size of the equity loan and ending with the size of the down payment. If you made a 5 percent down payment, you would get a mortgage for 80 percent of the price, borrow 15 percent as an equity loan or credit line and pay 5 percent cash. That would be called an 80-15-5 piggyback.

Two or three years ago, when you could get a home equity line of credit at 4 percent or 5 percent, piggybacks were almost always cheaper. But now the average line of credit sports a rate north of 8 percent, and the average home equity loan is a shade under 8 percent. And rates on credit lines and equity loans usually run a little higher on piggybacks.

Bottom line: Piggyback loans have higher monthly payments than they used to have, while mortgage insurance costs the same.

John Kneece info@JohnKneece.com

803-378-5208

Toll Free to you: 1-866-419-7539

(John Kneece is licensed under ERA WILDER REALTY, INC.)

Thursday, August 24, 2006

Orangeburg is Prime Investor Territory- SCSU and Claflin University assure it!

With TWO major Universities within the five mail radius of Orangeburg (metro)---- THIS IS IT for next year >>>>>>>

Echo boomers, children born between 1982 and 1995 to baby boomers, are about 80 million strong

RISMEDIA, August 24, 2006—“The student housing market is a good niche opportunity today,” said Kenneth T. Rosen, chairman of the Rosen Consulting Group, a real estate and economics research company in California. “The demographics are excellent, and the demand is great.”

Echo boomers, children born between 1982 and 1995 to baby boomers, are about 80 million strong. College enrollments have been on the rise while the supply of on-campus housing is dwindling.

Student housing projects are often leased by the bed, with parents increasingly guaranteeing the leases. The student housing market, which is estimated at $160 billion, has proven profitable for many investors. Capitalization rates can often exceed those on conventional multifamily projects.

Typical investors are independent companies and regional investment groups. Some tenants-in-common programs (TICs), offering fractional ownership of properties, also invest in student housing. Recently, three real estate investment trusts specializing in student housing have emerged — GMH Communities Trust, American Campus Communities and Education Realty Trust — making the sector more accessible to passive investors with less money to invest.

Through July of this year, American Campus Communities had a total return (price appreciation and dividend) of 10.07% while Education Realty returned 28.76%, according to the National Association of Real Estate Investment Trusts. By comparison, the total return for all equity REITs during that period was 16.12%, the association said.

Typically, student housing occupancy is near 100%. “The success of these investments is tied to college enrollment, not to external economic factors like job creation,” Michael H. Zaransky of Prime Property Investors and author, said. “In fact, one can argue that in bad economic times, people will want to pursue better credentials and go back to school.”

If you have money you would like to see making a brighter future for you--- call John Kneece at 803-378-5208 and discover how investing in student rentals can be your ticket to the biggest and most lucretive show in town!!

Echo boomers, children born between 1982 and 1995 to baby boomers, are about 80 million strong

RISMEDIA, August 24, 2006—“The student housing market is a good niche opportunity today,” said Kenneth T. Rosen, chairman of the Rosen Consulting Group, a real estate and economics research company in California. “The demographics are excellent, and the demand is great.”

Echo boomers, children born between 1982 and 1995 to baby boomers, are about 80 million strong. College enrollments have been on the rise while the supply of on-campus housing is dwindling.

Student housing projects are often leased by the bed, with parents increasingly guaranteeing the leases. The student housing market, which is estimated at $160 billion, has proven profitable for many investors. Capitalization rates can often exceed those on conventional multifamily projects.

Typical investors are independent companies and regional investment groups. Some tenants-in-common programs (TICs), offering fractional ownership of properties, also invest in student housing. Recently, three real estate investment trusts specializing in student housing have emerged — GMH Communities Trust, American Campus Communities and Education Realty Trust — making the sector more accessible to passive investors with less money to invest.

Through July of this year, American Campus Communities had a total return (price appreciation and dividend) of 10.07% while Education Realty returned 28.76%, according to the National Association of Real Estate Investment Trusts. By comparison, the total return for all equity REITs during that period was 16.12%, the association said.

Typically, student housing occupancy is near 100%. “The success of these investments is tied to college enrollment, not to external economic factors like job creation,” Michael H. Zaransky of Prime Property Investors and author, said. “In fact, one can argue that in bad economic times, people will want to pursue better credentials and go back to school.”

If you have money you would like to see making a brighter future for you--- call John Kneece at 803-378-5208 and discover how investing in student rentals can be your ticket to the biggest and most lucretive show in town!!

Friday, August 18, 2006

Own a home, grab the tax breaks

Own a home, grab the tax breaks

By Leonard Wiener

Posted 8/15/06

Related Links

· Retirement taxes: pay now or later?

· Tax traps can snare your capital gains

· Capital-gains tax difficulties

· Perpetual family trusts

· Kiddie tax changes

· More from Money & Business

The housing market may swell and ebb. But Uncle Sam keeps giving.

When President Bush last month decided it was time to address the NAACP, one message that won applause was endorsement of the American real-estate ideal.

"Owning a home gives people a stake in their neighborhood, a stake in the future," he declared.

The tax code backs up reverence for owning your abode with tax deductions for mortgage interest and property tax that in effect reduce your monthly bill. And some or all of your profit when you sell may face no tax at all.

An analysis released in late June by economist Robert Dietz of the National Association of Home Builders calculated that about 35 million households claimed $338 billion in mortgage deductions on 2003 returns, an average of $9,650. About 39 million deducted $119 billion in real-estate tax, an average of $3,000.

California led the nation in mortgage deductions with a statewide average of about $14,000 and a whopping $35,000 in the San Jose area.

High home prices and stiff real-estate taxes pushed New Jersey to the top spot in property-tax deductions, with an average of $6,000.

The builders played a political card in breaking out by congressional district the extensive use of the deductions. Some economists and tax reformers say the incentives encourage buying bigger homes than needed and boost prices by turning homes into a tax strategy. But howls from homeowners and real-estate groups restrain any moves to curb the breaks.

Losers? The five congressional districts making least use of the mortgage deduction were all in the New York City area, where renters loom large, highlighting the left-out feeling many non-owners sense.

"Deductions for home interest and property tax are often what allow first-time buyers to make a transition from taking the standard deduction to itemizing deductions," says Maggie Doedtman, a senior manager at H&R Block.

Melonie Loeb, a 30-year-old single mother in Overland Park, Kan., and fellow Block employee, took on a three-bedroom ranch in 2004, allowing her to deduct $16,141 in itemized deductions on her 2005 return. That eclipsed the $7,300 head-of-household standard deduction she would have taken as a renter.

Loeb is relieved that her 5-year-old daughter "can be loud without disturbing the neighbors." But she has also bought into the game plan of building equity. "The money I spent in rent went nowhere," she says.

Even revered breaks, however, have limits.

IRS Publication 530 provides a tax overview for first-time owners. Publication 523 covers selling a home. Publication 936 explains mortgage and home-equity deductions.

By Leonard Wiener

Posted 8/15/06

Related Links

· Retirement taxes: pay now or later?

· Tax traps can snare your capital gains

· Capital-gains tax difficulties

· Perpetual family trusts

· Kiddie tax changes

· More from Money & Business

The housing market may swell and ebb. But Uncle Sam keeps giving.

When President Bush last month decided it was time to address the NAACP, one message that won applause was endorsement of the American real-estate ideal.

"Owning a home gives people a stake in their neighborhood, a stake in the future," he declared.

The tax code backs up reverence for owning your abode with tax deductions for mortgage interest and property tax that in effect reduce your monthly bill. And some or all of your profit when you sell may face no tax at all.

An analysis released in late June by economist Robert Dietz of the National Association of Home Builders calculated that about 35 million households claimed $338 billion in mortgage deductions on 2003 returns, an average of $9,650. About 39 million deducted $119 billion in real-estate tax, an average of $3,000.

California led the nation in mortgage deductions with a statewide average of about $14,000 and a whopping $35,000 in the San Jose area.

High home prices and stiff real-estate taxes pushed New Jersey to the top spot in property-tax deductions, with an average of $6,000.

The builders played a political card in breaking out by congressional district the extensive use of the deductions. Some economists and tax reformers say the incentives encourage buying bigger homes than needed and boost prices by turning homes into a tax strategy. But howls from homeowners and real-estate groups restrain any moves to curb the breaks.

Losers? The five congressional districts making least use of the mortgage deduction were all in the New York City area, where renters loom large, highlighting the left-out feeling many non-owners sense.

"Deductions for home interest and property tax are often what allow first-time buyers to make a transition from taking the standard deduction to itemizing deductions," says Maggie Doedtman, a senior manager at H&R Block.

Melonie Loeb, a 30-year-old single mother in Overland Park, Kan., and fellow Block employee, took on a three-bedroom ranch in 2004, allowing her to deduct $16,141 in itemized deductions on her 2005 return. That eclipsed the $7,300 head-of-household standard deduction she would have taken as a renter.

Loeb is relieved that her 5-year-old daughter "can be loud without disturbing the neighbors." But she has also bought into the game plan of building equity. "The money I spent in rent went nowhere," she says.

Even revered breaks, however, have limits.

IRS Publication 530 provides a tax overview for first-time owners. Publication 523 covers selling a home. Publication 936 explains mortgage and home-equity deductions.

Saturday, August 12, 2006

Buyers in Orangeburg do have a choice- get what you deserve!

Experience:

My early background was in production management- a problem solver no doubt- I have lived in this market since 1975 and have worked with over 800 buyers and sellers since 1990.

Specializing: Relocation, Second Homes, and First-time home buyers

Help for buyers relocating to Orangeburg, Calhoun, or Bamberg Counties.

Financial expertise is invaluable when entering a different marketplace. John Kneece has spent many hours in seminars learning to assure that you get what you deserve without the hassle you could experience in the absence of good training and professional application of skills. (Mortgage Broker fees do not have to be part of your expenses in home buying)

John Kneece

ERA Wilder Realty, Inc.

1995 St. Matthews Road

Orangeburg, SC 29118

info@JohnKneece.com

WEB: www.OrangeburgHomes.com

CALL ME: locally (378-5208)

TOLL FREE: 1-866-419-7539

I have agents in all parts of Columbia, Rock Hill, Charlotte, Lake Norman, Lake Marion/Santee, SC, Sumter, and Lexington-

Do not throw darts at a board to choose an agent- allow me to put you in touch with one of our 400+ EXPERT RESIDENTIAL AGENTS... ERA-- that's what we do!!

My early background was in production management- a problem solver no doubt- I have lived in this market since 1975 and have worked with over 800 buyers and sellers since 1990.

Specializing: Relocation, Second Homes, and First-time home buyers

Help for buyers relocating to Orangeburg, Calhoun, or Bamberg Counties.

Financial expertise is invaluable when entering a different marketplace. John Kneece has spent many hours in seminars learning to assure that you get what you deserve without the hassle you could experience in the absence of good training and professional application of skills. (Mortgage Broker fees do not have to be part of your expenses in home buying)

John Kneece

ERA Wilder Realty, Inc.

1995 St. Matthews Road

Orangeburg, SC 29118

info@JohnKneece.com

WEB: www.OrangeburgHomes.com

CALL ME: locally (378-5208)

TOLL FREE: 1-866-419-7539

I have agents in all parts of Columbia, Rock Hill, Charlotte, Lake Norman, Lake Marion/Santee, SC, Sumter, and Lexington-

Do not throw darts at a board to choose an agent- allow me to put you in touch with one of our 400+ EXPERT RESIDENTIAL AGENTS... ERA-- that's what we do!!

Thursday, August 10, 2006

Orangeburg County will be sustained because...

Here is a quote published by RESMEDIA recently- The relevance of this comment lies in the part that says. “…especially in moderately priced areas where affordability conditions remain favorable….” This is ORANGEBURG COUNTY for certain!

"On one hand is the rise in mortgage interest rates that has slowed sales in many higher-cost markets, and on the other is 3.8 million new jobs over the last two years," Lereah said. "This means many potential home buyers could enter the market in the foreseeable future, especially in moderately priced areas where affordability conditions remain favorable. In fact, this is already occurring."

John Kneece the owner and developer of the localized website, www.OrangeburgHomes.com, has enjoyed helping folks who are drawn into this void- good prices and great employment. Visit the site to see over 800 homes and properties for sale in the area. Relocation is king with John Kneece and Orangeburg Homes dot Com. John Kneece is a 16 year veteran in the real estate services area and has functioned in the Orangeburg-Bamberg-Calhoun County market continuously for that time. John is currently associated with the multi-State real estate company, ERA Wilder Realty, Inc. Having direct access to agents in 17 different market all whom adhere to the same rules, ethics, and systems make John Kneece and Orangeburg Homes dot Com even more effective when families need information and help in areas of North Carolina and South Carolina which John does not personally service.

803-378-5208

mailto:info@JohnKneece.com

"On one hand is the rise in mortgage interest rates that has slowed sales in many higher-cost markets, and on the other is 3.8 million new jobs over the last two years," Lereah said. "This means many potential home buyers could enter the market in the foreseeable future, especially in moderately priced areas where affordability conditions remain favorable. In fact, this is already occurring."

John Kneece the owner and developer of the localized website, www.OrangeburgHomes.com, has enjoyed helping folks who are drawn into this void- good prices and great employment. Visit the site to see over 800 homes and properties for sale in the area. Relocation is king with John Kneece and Orangeburg Homes dot Com. John Kneece is a 16 year veteran in the real estate services area and has functioned in the Orangeburg-Bamberg-Calhoun County market continuously for that time. John is currently associated with the multi-State real estate company, ERA Wilder Realty, Inc. Having direct access to agents in 17 different market all whom adhere to the same rules, ethics, and systems make John Kneece and Orangeburg Homes dot Com even more effective when families need information and help in areas of North Carolina and South Carolina which John does not personally service.

803-378-5208

mailto:info@JohnKneece.com

Wednesday, August 09, 2006

Orangeburg South Carolina uses FHA zero-down loans

FHA wants to insure zero-down mortgages

By Holden Lewis (An expert I rely upon)

Zero-down home loans have gone so mainstream that the federal government wants to get into the act.

Borrowers would be able to take out no-money-down mortgages insured by the Federal Housing Administration under a proposal by the housing department. Right now, FHA-insured loans are limited to a maximum of 97 percent of the home's price, meaning that homeowners have to come up with a 3 percent down payment.

FHA-insured, zero-down loans won't be available until October at the earliest, because the proposal will be included in the Department of Housing and Urban Development's fiscal 2005 budget proposal. The fiscal year begins Oct. 1. Allowing zero-down, FHA-insured mortgages would require congressional approval.

Under the proposal, home buyers not only would be able to get FHA-insured loans with no money down, but they could roll some closing costs into the loan. The maximum loan size, then, would be 103 percent of the home's price.

Help for first-time buyersThe proposed change would remove the biggest obstacle facing first-time home buyers, says John Weicher, the federal housing commissioner. "This initiative would not only address a major hurdle to homeownership and allow many renters to afford their own home, it would help these families build wealth and become true stakeholders in their communities," Weicher says.

The Bush administration has a goal to create 5.5 million new minority homeowners by 2010. The FHA estimates that the zero-down option would generate 150,000 new homeowners in the first year.

Not many years ago, zero-down loans for consumers were rare. Later, they were a fringe product. They are riskier for lenders because zero-down borrowers are deemed more likely to default, and when they do default, the lender is more likely to lose money. But as mainstream mortgage lenders have found that they can make money by lending to shaky borrowers at high rates, zero-down loans have become widely available. Now, under HUD's proposal, lenders would be able to offer zero-down loans and let the FHA insurance pool assume the risk. The insurance pool is funded by borrowers, not by taxpayers.

How they would workFHA borrowers would pay more, both upfront and monthly, for the privilege of not making a down payment. Today, if a home buyer makes a 3 percent down payment and gets an FHA-insured mortgage, the buyer pays an upfront mortgage insurance premium of 1.5 percent at closing, and half a percentage point is tacked onto the interest rate. Under the proposal, a riskier zero-down loan would incur a mortgage insurance premium of 2.25 percent at closing, and three-quarters of a percentage point would be added to the interest rate for the first five years of the loan. After five years, the interest rate would be reduced by one-quarter point.

It would mean slightly higher payments for zero-down borrowers. Consider the case of Jack, who puts 3 percent down and borrows $100,000, and Jill, who gets a zero-down loan for $100,000. Both get their loans when mortgage rates average 6 percent for people with good credit who put 20 percent down.